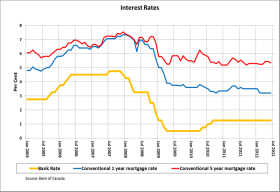

The Bank of Canada kept its trend-setting Bank Rate at 1.25 per cent on June 5th, 2012. It was the 14thconsecutive policy meeting in which borrowing costs have been left unchanged.

While the text accompanying the announcement left the door open to future rate hikes, the language used was considerably less hawkish than in the previous announcement in April as the Bank sounded a cautious tone over the recent deterioration of the situation in Europe.

The announcement begins, “The outlook for global economic growth has weakened in recent weeks. Some of the risks around the European crisis are materializing and risks remain skewed to the downside. This is leading to a sharp deterioration in global financial conditions.”

The Bank also noted that while the U.S. economy was continuing to expand, albeit modestly, emerging economies were slowing faster and a bit more broadly than expected. That more modest global momentum combined with heightened financial risk aversion has led to lower commodity prices, which is weighing on Canadian exports.

Canadian economic growth was slower than the Bank expected in the first quarter of the year, 1.9 per cent compared to a projected 2.5 per cent; however, underlying economic momentum remains in line with expectations.

That said, the composition of growth has become less balanced. Specifically, housing activity has been stronger than the Bank had been expecting, and despite external risks, business and household confidence has remained resilient amid very stimulative domestic financial conditions.

In contrast, the contribution to growth from government spending is expected to be quite modest going forward in line with recent federal and provincial budgets. Additionally, the recovery in net exports is likely to remain weak in light of the combination of reduced external demand and ongoing competitiveness challenges, including the persistent strength of the Canadian dollar.

The Bank said the Canadian economy continues to operate with a small degree of excess capacity, and that even though headline CPI inflation was expected to fall below 2 per cent in the short term due to lower gasoline prices, the core rate inflation was expected to remain around the target 2 per cent mark.

The announcement ended by reiterating that, to the extent that the economic expansion continues and the current excess supply in the economy is gradually absorbed, the possibility of a rate hike was not completely off the table, but that the timing and degree of any such action would depend heavily upon how current heightened downside risks play out in the months ahead.

As of June 5th 2012, the advertised five-year lending rate stood at 5.34 per cent. This is down 0.1 percentage points from 5.44 per cent on April 17th, when the Bank made its previous policy interest rate announcement.

The Bank will make its next scheduled rate announcement on July 17th, 2012.

Source: CREA

![[small-rates-logo-alt]](http://www.ratehub.ca/images/logo-small-right.png)

.png)

.png)

Posted by Theo Wu